• The Equator Principles is a risk management framework, adopted by financial institutions, for determining, assessing and managing environmental and social risk in projects and is primarily intended to provide a minimum standard for due diligence and monitoring to support responsible risk decision-making

• Currently 105 Equator Financial Institutions (EPFIs) in 38 countries have officially adopted the Principles, covering the majority of international project finance debt within developed and emerging markets

• First Abu Dhabi Bank is a member since 2015

• Other regional banks include: Arab African International bank (Egypt), Bank Muscat (Oman)

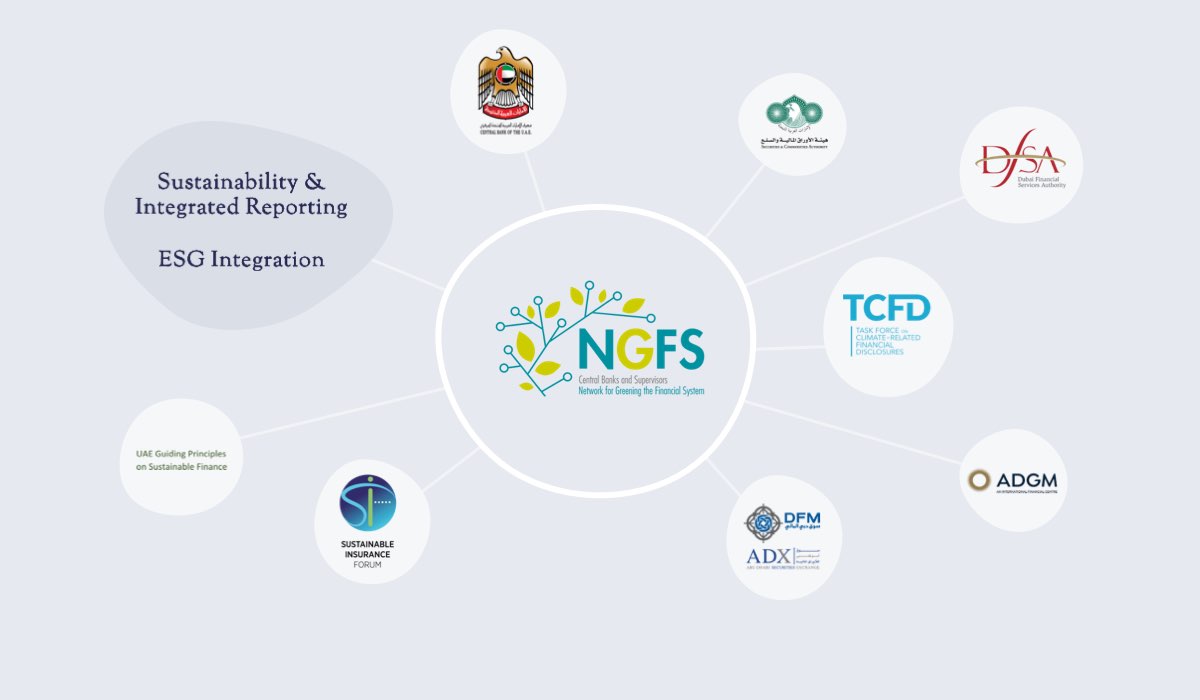

• The Network for Greening the Financial System, launched at the Paris One Planet Summit on 12 December 2017, is a group of Central Banks and Supervisors willing, on a voluntary basis, to share best practices and contribute to the development of environment and climate risk management in the financial sector and to mobilize mainstream finance to support the transition toward a sustainable economy

• Both the Abu Dhabi Global Market and the Dubai Financial Services Authority are members

• Green Bonds enable capital-raising and investment for new and existing projects with environmental benefits

• The Green Bonds Principles are voluntary process guidelines that recommend transparency and disclosure and promote integrity in the development of the Green Bond market by clarifying the approach for insurance of a Green Bond

•

The Principles for Responsible Investment

is the world’s leading proponent of responsible investment

• It works to understand the investment implications of environmental, social, and governance factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decision

• Total 2,800 signatories with AUM surpassing $110 trillion so far in 2020

• The United Nations Environment Programme – Finance Initiative

Principles for Sustainable Insurance

serves as a global framework for the insurance industry to address environmental, social and governance risks and opportunities

• The Principles have led to the largest collaborative initiative between the UN and the insurance industry

• Over 140 organisations worldwide have adopted the Principles including insurers representing more than 25% of world premium volume and USD 14 trillion in assets under management

•

The Principles for Responsible Banking

are a unique framework for ensuring that signatory banks’ strategy and practice align with the vision society has set out for its future in the Sustainable Development Goals and the Paris Climate Agreement

• More than 180 banks have joined, representing more than a third of the global banking industry

• Climate Bonds Initiative is an international organisation (investor-focused not-for-profit) working solely to mobilise the largest capital market of all, the $100 trillion bond market, for climate change solutions

• The initiative promotes investment projects and assets necessary for rapid transition to a low carbon and climate resilient economy

• The strategy is to develop a large and liquid Green and Climate Bonds Market that will help drive down the cost of capital for climate projects in developed and emerging markets; to grow aggregation mechanisms for fragmented sectors; and to support governments seeking to tap debt capital markets

• The FTSE4Good Index Series is designed to measure the performance of companies demonstrating strong ESG practices

• FTSE4Good Emerging Indexes Series is a series of benchmark and tradable indexes for ESG investors, which was launched in 2001. The FTSE4Good criteria is applied to the FTSE Emerging Indexes, which covers over 20 emerging countries, and was launched in 2016

• The Dubai Financial Market, First Abu Dhabi Bank, and Hikma Pharmaceuticals were at some point made constituents of the index

• ISO 26000 is for businesses and organizations committed to operating in a socially responsible way

• It provides guidance to those who recognize that respect for society and environment is a critical success factor

• Application of ISO 26000 is increasingly viewed as a way of assessing an organization’s commitment to sustainability and its overall performance

• The FC4S Network is a partnership between the world’s financial centres and the UNEP which serves as its convenor and Secretariat

• The objective of the Network is to enable financial centres to exchange experiences, drive convergence and take action on shared priorities to accelerate the expansion of green and sustainable finance

• The Abu Dhabi Global Market is one of 22 members

• A network of insurance supervisors and regulators from around the world who are working together on sustainability challenges facing the insurance sector

• The United Nations Environment Programme serves as the Sustainable Insurance Forum (SIF) Secretariat

• As of July 2020, the SIF has 31 jurisdictions as members

• The Group was set up to assist the EU in developing:

– An EU classification system – the so-called EU taxonomy – to determine whether an economic activity is environmentally sustainable

– An EU Green Bond Standard

– Methodologies for EU climate benchmarks and disclosures for benchmarks

– Guidance to improve corporate disclosure of climate-related information

• The Group has also worked on disclosure requirements in relation to ESG factors

• IFC’s Environmental and Social Performance Standards define IFC client’s responsibilities for managing their environmental and social risks

• There are 6 standards which include:

– Risk Management

– Labour

– Resource Efficiency

– Community

– Land Resettlement

– Biodiversity

– Indigenous people

– Cultural Heritage

• CDSB is an international consortium of business and environmental NGOs committed to advancing and aligning the global mainstream corporate reporting model to equate natural capital with financial capital

• CDSB offers companies a framework for reporting environmental information with the same rigour as financial information

• Aligns with the recommendations of the Task Force on Climate-related Financial Disclosures

• Builds on the most widely used reporting approaches, such as CDP Global, GRI, SASB, and IFRS

• CDP runs the global environmental disclosure system. Each year CDP supports thousands of companies, cities, states and regions to measure and manage their risks and opportunities on climate change, water security and deforestation

• CDP disclosures cover climate change, forests and water security

• Companies are asked to disclose through CDP by their customers and investors. By completing CDP’s questionnaires on climate change, forests and water security, companies will identify ways to help them manage their own environmental risks and opportunities as well as providing vital information back to their customers and investors, and to the market through research, insights and financial products and services

• CDP reporting is fully aligned with the best-practice TCFD recommendations

• The Sustainable Stock Exchanges Initiative’s mission is to provide a global platform for exploring how exchanges, in collaboration with investors, companies (issuers), regulators, policymakers and relevant international organizations, can enhance performance on ESG issues and encourage sustainable investment, including the financing of the UN Sustainable Development Goals

• Total exchange members include 103 with a total of 52,931 listed companies, and a total market cap of $88.2 trillion

• The initiative encourages the creation of sustainability-related indices, issuing ESG reporting guidance, and other

• Both the Dubai Financial Market (2016) and the Abu Dhabi Securities Exchange (2019) are members

The UNEP is the leading global environmental authority that sets the global environmental agenda, promotes the coherent implementation of the environmental dimension of sustainable development within the United Nations system, and services as an authoritative advocate for the global environment

• SASB standards enable businesses around the world to identify, manage and communicate financially-material sustainability information to their investors

• SASB has developed a complete set of 77 industry standards which identify the minimal set of financially material sustainability topics and their associated metrics for the typical company in an industry

• SASB standards have been used in more than 200 countries and by investors with over $48 trillion in AUM

• SASB and GRI are mutually supportive and are designed to fulfil different purposes. SASB standards focus on ESG issues expected to have a financially material impact on the company, aimed at serving the needs of most investors. GRI standards focus on the economic, environmental, and social impacts of the activities of a company, and hence its contributions towards sustainable development, which is of interest to a broad range of stakeholders including investors

• The Task Force on Climate-Related Financial Disclosures (TCFD) takes the Paris Agreement’s two degrees Celsius target and operationalizes it for the business world

• The TCFD seeks to develop recommendations for voluntary climate-related financial disclosures that are consistent, comparable, reliable, clear, and efficient, and provide decision-useful information to lenders, insurers, and investors

• The TCFD’s 31 members were chosen by the financial stability board to include both users and preparers of disclosures from across the G20 constituency covering a broad range of economic sectors and financial markets

• The UAE Insurance Authority as well as First Abu Dhabi Bank are official supporters of the TCFD

• The Paris Agreement builds on the United Nations Framework Convention on Climate Change and for the first time brings all nations into a common cause to undertake ambitious efforts to combat climate change and adapt to its effects, with enhanced support to assist developing countries to do so

• The Paris Agreement central aim is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees Celsius

• The UAE formally ratified the Paris Climate Agreement on September 4, 2016

• The UN entity tasked with supporting the global response to the threat of climate change

• The Convention is the parent treaty of the 2015 Paris Agreement as well as that of the 1997 Kyoto Protocol

• The ultimate objective of all three agreements under the Convention is to stabilize greenhouse gas concentrations in the atmosphere at a level that will prevent dangerous human interference with the climate system, in a time frame which allows ecosystems to adapt naturally and enables sustainable development

• The UN Global Compact aims to mobilize a global movement of sustainable companies and stakeholders to create a sustainable world.

To make this happen, the initiative supports companies to:

– Do business responsibly by aligning their strategies and operations with Ten Principles on human rights, labour, environment, and anti-corruption; and

– Take strategic actions to advance broader societal goals, such as the UN Sustainable Development Goals, with an emphasis on collaboration and innovation

• There are currently more than 11,000 signatory companies across 157 countries

• The International Integrated Reporting Council is a global coalition of regulators, investors, companies, standard setters, the accounting profession, academia and NGOs. The coalition promotes communication about value creation as the next step in the evolution of corporate reporting

• Integrated reporting is a process founded on integrated thinking that results in a periodic integrated report by an organization about value creation over time and related communications regarding aspects of value creation

• An integrated report is a concise communication about how an organization’s strategy, governance, performance and prospects, in the context of its external environment, lead to the creation of value in the short, medium and long term

• The SDGs are a universal call to action to end poverty, protect the planet and improve the lives and prospects of everyone, everywhere. The 17 goals were adopted by all UN Member States in 2015, as part of the 2030 Agenda for Sustainable Development which set out a 15-year plan to achieve the goals

• All stakeholders, governments, civil society, the private sector, and others, are expected to contribute to the realisation of the new agenda

• The Global Reporting Initiative (GRI) is an independent international organization that has pioneered sustainability reporting since 1997

• GRI helps businesses and governments worldwide understand and communicate their impact on critical sustainability issues such as climate change, human rights, governance and social well-being. This enables real action to create social, environmental and economic benefits for everyone. The GRI Sustainability Reporting Standards are developed with true multi-stakeholder contributions and rooted in the public interest

• The GRI Sustainability Reporting Standards are the first and most widely adopted global standards for sustainability reporting

• The guiding principles represent the shared views of the regulatory authorities in the UAE and serve as a catalyst in the implementation of the UAE’s sustainability priorities

• These are the UAE’s first guiding principles on sustainable finance. The guiding principles are designed to encourage signatories to intensify their efforts to achieve increased implementation and integration of sustainable practices among the UAE’s financial entities and to secure a sustainable economic future for the UAE

• Principle 1: Integration of ESG factors into Governance, Strategy, and Risk Management

• Principle 2: Minimum Eligibility Requirements

• Principle 3: Promotion of Appropriate ESG-Related Reporting Disclosures

•

ADX

has launched its first Sustainability Report in June 2020

• ADX aims to improve its market position in the region. By encouraging listed companies to be transparent and provide reports that show their alignment with ESG guiding principles, companies will prove to be more attractive to investors and eventually make a positive impact on the economy of the UAE

• Issued an ESG disclosure guidelines in July 2019

• “the importance of these reports is also evidenced by the investor’s interest in sustainability as investors and agencies perform a rating analysis of the ESG disclosure performance of the listed company”

• “The investment community often interprets the lack of disclosure of key sustainability indicators as a signal that the company may not be able to mitigate the risks of sustainability or seize opportunities”

• ADX’s plan also makes essential contributions towards the UN Sustainable Development Goals (SDGs), and the delivery of many of these targets have been enshrined in decree by the UAE cabinet through the UAE National Committee on SDGs

•

DFM

’s sustainability strategy aims to lead as the region’s sustainable marketplace by creating long-term shared value for DFM stakeholders by 2025

• DFM’s sustainability policy prioritizes sustainability in every aspect of its corporate strategy and organizational operations to create this value. The four pillars of the DFM Sustainability Strategy are:

• Sustainability Reporting & Disclosures

• Sustainable investment education

• Green products & listings

• Gender Balance & empowering people

• The DFM launched in December 2019 its ESG Reporting Guide

• ADGM aims to develop a vibrant and thriving sustainable finance hub

• To create a vibrant sustainable finance hub, ADGM is working on four pillars as follows:

– Integration of sustainability into the regulatory framework of ADGM

– Building cooperation with national and international stakeholders

– Fostering communication, knowledge and awareness

– Creation of a sustainable finance ecosystem in ADGM

• Sustainability Reporting related: ADGM will introduce suitable disclosure standards for relevant ADGM entities, initially on a voluntary basis, such as the recommendations of the Task Force on Climate-related Financial Disclosures. These global best practices are fast becoming the baseline expectation for identifying, assessing and disclosing climate risks, and are consistent with the Global Reporting Initiative

• ADGM issued its Sustainability Principles in 2019, some of the principles include:

– Encouraging firms operating in the ADGM to incorporate ESG factors into their business operations

The S&P/Hawkamah ESG UAE Index is designed to measure the performance of 20 of the best-performing stocks in the UAE as measured by environmental, social and governance (ESG) factors

• The Central Bank of the UAE promotes financial and monetary stability, efficiency and resilience in the financial system, and the protection of consumers through effective supervision that supports economic growth for the benefit of the UAE and its people

• The Central Bank of the UAE supports and is a signatory to multiple UAE sustainability initiatives such as the UAE Guiding Principles on Sustainable Finance

• The Dubai Financial Services Authority (DFSA) is the independent regulator of financial services conducted in or from the Dubai International Financial Centre (leading financial hub in the Middle East, Africa and South Asia).

• Signatories of multiple Sustainable initiatives and aligned with the UAE Sustainable initiatives

• The Securities and Commodities Authority’s (SCA) main objective is to supervise and monitor the capital markets

• The SCA has issued a Master Plan for Sustainable Capital Markets to support and drive progress on the achievement of the UAE’s sustainability agenda

• Some of the key objectives of the Master Plan include:

– Providing channels for funding of sustainable projects

– Creating awareness with all market stakeholders on the importance of sustainability and their respective role in supporting it through their actions

• The SCA intends to use a combination of 1) incentives and voluntary implementation on the one hand and 2) mandatory regulatory requirements on the other

• UAE’s National Committee on SDGs was formed by decree of the UAE Cabinet in January 2017

• The Federal Competitiveness and Statistics Authority (FCSA) serves as vice-chair and secretariat for the Committee

• The Committee is composed of 17 Federal level government organizations and is responsible for the national implementation of the SDGs, monitoring and reporting of progress targets and stakeholder engagement

• In 2016, the UAE leadership expanded the role of the Ministry of Environment and Water, to manage all aspects related to international and domestic climate change affairs

• The Establishment of the Ministry was an important milestone. It enhanced the UAE’s efforts to addressing the issue of climate change, through the implementation of comprehensive policies and initiatives to mitigate and adapt to climate change and protect the UAE’s unique environmental systems

• In 2017, the UAE launched “Energy Strategy 2050”, which is considered the first unified energy strategy in the country that is based on supply and demand. The strategy aims to increase the contribution of clean energy in the total energy mix from 25% to 50% by 2050 and reduce carbon footprint of power generation by 70%, thus saving AED 700 billion by 2050. It also seeks to increase consumption efficiency of individuals and corporates by 40%. The strategy will aim to invest AED 600 billion to meet demands for energy and ensuring the sustainability of growth in the UAE’s economy.

• The strategy targets an energy mix that combines renewable, nuclear and clean energy sources to meet the UAE’s economic requirements and environmental goals as follows:

– 44% clean energy

– 38% gas

– 12% clean coal

– 6% nuclear

• Pillars of UAE Energy Strategy 2050: 1. Infrastructure 2. Legislation 3. Dubai Green Fund 4. Building Capacities and Skills 5. UAE Energy Mix 2050

• National Climate Change Plan of the UAE is the UAE’s comprehensive framework to address the causes and impacts of climate change, plan the transition into a climate resilient green economy and achieve a better quality of life

• The plan will serve as a road map to bolster nationwide action for climate mitigation and adaptation in the UAE to 2050. The objectives are three-fold – managing greenhouse emissions while sustaining economic growth, building climate resilience through stronger climate adaptation and advancing the UAE’s economic diversification agenda through innovative solutions

• In January 2015, the UAE Cabinet issued a decision to approve and implement the UAE Green Agenda as an overarching framework of actions for the Green Economy for Sustainable Development Initiative

• In line with the Vision 2021 and each Emirates’ long-term development plan, five strategic objectives and twelve main programs were set under the Agenda

1. Competitive Knowledge Economy

2. Social Development and Quality of Life

3. Sustainable Development and Valued Natural Resources

4. Clean Energy and Climate Action

5. Green Life and Sustainable Use of Resources

• The UAE has deployed extensive efforts towards driving sustainability forward with the framework of UAE Vision 2021 and in alignment with the UN Sustainable Development Goals. The vision consists of six key pillars aimed at ensuring a sustainable environment and infrastructure:

– World-Class Healthcare

– Competitive Knowledge Economy

– Safe Public and Fair Judiciary

– Cohesive Society and Preserved Identity

– First-Rate Education System

– Sustainable Environment and Infrastructure

• The UAE vision 2021 focuses on improving the quality of air, preserving water resources, increasing the contribution of clean energy and implementing green growth plans